🌲 Reading this article, you will understand:

- Naver Commerce is being shaken both internally and externally. The internal crisis is the increasingly deepening stagnation in commerce transaction growth. The external crisis can be seen in Japan, a key ally in the cross-border commerce ecosystem that Naver wanted to create. As both Korea and Japan face crises, they both stir significant anxiety. This article interprets the signals of crisis Naver faces based on the Q1 2024 commerce data and compiles thoughts from CEO Choi Soo-yeon.

- Whenever questions arise about Naver's stagnation in transaction growth, one company that consistently gets mentioned is "Coupang." Although Coupang was seen as forming a duopoly with Naver during the pandemic, flourishing together, recently, it seems Coupang has been monopolizing growth. CEO Choi Soo-yeon acknowledged Naver’s stagnation but mentioned that there are external factors that must also be considered.

- Regarding issues of the Japanese government pressuring Naver to sell its stakes in Line Yahoo, CEO Choi Soo-yeon also commented. It’s a delicate issue intertwined with international relations between the Korean and Japanese governments, so no detailed comments were made. However, it was clear that the cooperative relationship between Naver and Line Yahoo has changed.

- Despite the significant anxiety facing Naver, there were positive developments in Q1 for Naver Commerce, particularly with Poshmark and the membership business. Building on this, Naver plans to continue forging a unique path unlike any other worldwide, different from Coupang and Line Yahoo. This outlines the unique path Naver is pursuing in commerce.

CHAPTER 1: Naver Faces Massive Crises Both Internally and Externally

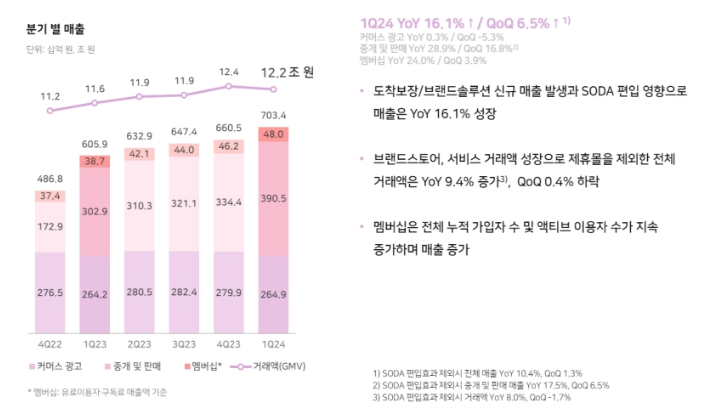

Naver Commerce is shaking both internally and externally. The internal crisis is the stagnation of commerce transaction growth. Since Q4 2023, when growth fell to less than half the market average, this stagnation has continued into Q1 2024. According to Naver, in Q1 2024, the total commerce transactions reached 12.2 trillion KRW, a 6% increase year-over-year, but this was below the Statistics Korea-reported average growth rate of 10.7% for the same period. Even compared to the previous quarter (12.4 trillion KRW), there was observed a reverse growth in transactions.

If there’s an added setback for Naver this quarter, it is that even its own operated Smart Store and Brand Store, known as 'On-platform products', are seeing a slowdown in growth. Naver reports that the year-over-year growth rate for Q1 2024 On-platform products (excluding the effects of acquiring the Japanese 'Soda') was only 8%. When looked at quarter-over-quarter, there was a 1.7% decline in transactions.

The external crisis is observed in Naver’s alliance front. Naver, aspiring to create a cross-border commerce ecosystem linking global sellers and buyers, has consistently pursued acquisitions and investments in e-commerce platforms globally. The largest and starting point of these alliances would be Japan’s 'Line Yahoo (LY Corporation)'. In 2021, Naver and Japan's SoftBank jointly established A Holdings as a holding company controlling Line Yahoo (then Z Holdings) with a 50:50 investment.

However, the Japanese government began pressuring last year, using a personal information leak at Line as a pretext to administratively guide and push for a restructuring of Line Yahoo, which includes selling Naver’s stake in A Holdings to SoftBank.

This has shaken the foundation of the collaboration blueprint originally announced by the two companies, involving technology transfer from Naver and local service operations by Line Yahoo. Meanwhile, the first collaborative project between Naver and Line Yahoo, the Japanese version of Smart Store 'My Smart Store', has decided to terminate services by July. While it’s difficult to pinpoint the exact relationship between this event and the Japanese government's pressure, it’s clear that the business in Japan was far from smooth.

During Naver's Q1 2024 earnings call on May 3, the sense of crisis for Naver was palpable. Although the management tried to minimize references to these issues during their speeches, most of the analysts' questions focused on asking about Naver's response to the transaction growth stagnation and the Japanese government’s pressure. Today's content aims to summarize CEO Choi Soo-yeon’s thoughts on these issues, along with the future direction of Naver Commerce.